What does KYC mean?

KYC(Know Your Customer) means Know your customer. KYC(Know Your Customer) rules mean know your customer rules. KYC (Know Your Customer) rules keep an eye on the source and use of your customer’s funds to ensure that your customer’s operations, etc. are legal and compliant.

KYC (Know Your Customer) is the equivalent of a supervisory system that regulates its own customers and prevents its own customers from committing illegal acts. KYC(Know Your Customer) is also a policy that goes beyond just supervising customers; this regulatory policy also has a binding effect on customers. It’s like the law of the land that says you can’t intentionally hurt someone, so most people are bound to not hurt others. If there were no such laws, there would be many people who would not restrain themselves; they would get into fights.

And in the Internet era, many offline businesses have been moved online, greatly enhancing the efficiency of the process. But there is a problem that comes with it: security.

In the first step, merchants/enterprises/institutions need to solve the “user identity authenticity problem”, such as “is he him?” The next step is to solve the “user’s willingness to confirm”, such as “is he willing?” . This is the most basic and critical risk control step to make sure that the business is genuinely applied by the applicant himself.

However, for many merchants, confirming the user’s true identity is only the foundation for conducting business; the more complex challenge is determining the user’s risk.

As an example, consumer installment has become an important tool for many e-commerce platforms to attract new customers, retain them, and increase GMV. If a user of a platform is buying a high-value item in installment, the merchant has to reduce the platform’s risk by assessing the user’s relevant credit profile in addition to determining the user’s authenticity, the user’s willingness, and so on. So the merchant wants to know more about the user than identifying the user, he wants to know “what kind of a person is the user?”

Understanding your users is the most basic KYC, while profiling them is a further KYC(Know Your Customer).

The role of KYC(Know Your Customer)

KYC(Know Your Customer) is a regulatory policy and a guidance program. Its role is to protect the rights and interests of customers while also monitoring their operations. In fact, fully understanding customers’ operations and preventing them from breaking the law is also a way to protect customers’ rights and interests.

Safeguarding the value of the community

In the blockchain field, the real name system is required in all aspects of digital asset circulation, which is the general trend. Through the real-name system, the real participants of the community are selected to avoid the generation of false big data, which will certainly significantly enhance the value of blockchain coins.

To deal with the regulatory level

To deal with the regulatory level blockchain field is relatively chaotic, the regulator will not remain indifferent and will certainly make rules to regulate. The community is legal and compliant, and for the community to develop more healthily, it will fully cooperate when it needs to be regulated.

Protection of personal assets

Property rights are inevitably bound and regulated by law, and by the same token protected by law. Only by adopting a real-name system can we ensure that assets are not violated. Therefore, from the three aspects of community value, blockchain regulation and asset protection, choosing KYC real-name authentication is the way to the healthy development of the community. Develop the community, real name first, and work together to build a valuable community.

KYC(Know Your Customer) Applications

What we now know as KYC(Know Your Customer) is due to different application scenarios in their respective industries, and the forms of KYC encountered vary, so there will be a variety of understanding ambiguity products.

Industry-based KYC(Know Your Customer)

Bank Audit KYC(Know Your Customer).

National banks, and even various financial institutions around the world / securities / insurance / installment / digital currency platform, have their own set of KYC(Know Your Customer) process guidelines, the C-side users will carry out identity verification, capital verification. It is the beginning of the kyc/aml, mainly for capital risk control management.

Amazon e-commerce KYC(Know Your Customer).

Amazon needs to verify the identity of sellers who open stores in five European countries: the United Kingdom, France, Germany, Spain, Italy and other European countries.

Background check KYC.(Know Your Customer)

Mainly a three-party agency commissioned by the employer to conduct background checks KYC (Know Your Customer)certification of the candidate (authorized).

Security Industry KYC.(Know Your Customer)

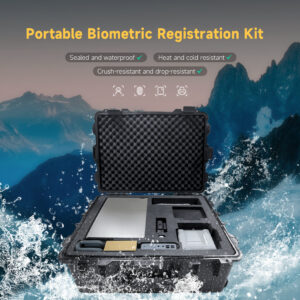

Mainly used in the field of security protection, like government / public security / traffic / community / schools / hospitals / shopping malls, monitoring personnel security / capture of fugitives, will use face matching, biometrics, location tracking and other technologies. We are also related to kyc, so we can expand our case studies if you are interested.

Functional KYC(Know Your Customer)

KYC (Know Your Customer)for users to prevent pickup.

This category is use, regardless of industry, but mainly in e-commerce, because e-commerce customer acquisition marketing, will issue a variety of welfare offers to the C-user, and some unscrupulous people are easy to exploit the platform loopholes, to carry out wool-gathering behavior.

Facilitating marketing KYC.(Know Your Customer)

The same functional use, do not distinguish between industries, but more is also used by the financial / customer unit price higher industries. The main application is to label new users and do user classification to help companies better identify their intended customers and thus complete the transaction profitably. This type of kyc provider is mainly used by operators, operator sp, advertising platforms, or platforms that have unique user data.

Audit-based KYC.(Know Your Customer)

The main application of KYC(Know Your Customer) is auditing and verification.

In traditional industries, KYC relies mainly on manual, channels such as public security/official data source verification, telephone verification, and the experience of professionals to judge. Therefore, the workload is large, the volume of users is limited, the size of the industry is limited, and it is difficult to standardize the manual part.

In recent years, KYC(Know Your Customer) has evolved to rely mainly on machine run decisions, or what we call big data risk control models. Through the mathematical science of computing runs, thousands of models are built to simulate judgments on more user data to make decisions. The advantages are obvious, so a large number of KYC(Know Your Customer) providers have emerged. This is because this type of KYC(Know Your Customer) requires a large amount of user data to feed the system. This must also be the future development and evolution of KYC.

Currently, from KYC(Know Your Customer), extends E-KYC, V-KYC …… million changes. The essence is still to make judgments about users through various types of data, so that decisions can be made and correct and effective business practices can be prompted.

The following will focus on KYC(Know Your Customer) for the security industry.

Mainly used in the field of security protection, like government / public security / traffic / community / schools / hospitals / shopping malls, monitoring personnel security / capture fugitives, will use to face matching, biometric, location tracking and other technologies. Also inseparably linked with kyc(Know Your Customer)

Installing KYC(Know Your Customer) in government/transportation/community/schools can guarantee the security of user information and the security of back-end data.

Benefits

Information security

安全かつ効率的

正確な識別

Easy compatibility

高い適応性

Highly selective

Product classification

Summary

Performing KYC(Know Your Customer) processes = safer, more efficient, and more accurate – because when AI technology is applied to KYC (Know Your Customer)processes, it not only helps financial institutions free up manpower and reduce labor costs, but also effectively improves operational efficiency: through new technical means, such as intelligent face recognition, live detection, and face matching, financial institutions’ customer identification review has also become more sensitive and has wider coverage, and the accuracy and effectiveness of risk prevention has been further improved. For the customers of financial institutions, such transformation has also increased a lot of convenience. Previously, it took half a month and several trips to the counter to complete the account opening review, but now customers can even no longer need to go to the financial institution site, through the remote “no meeting” method, only a few minutes to complete the KYC review.