Biometrics technology has had a significant impact on the fintech industry, changing the way financial transactions are authenticated and improving security. Biometric authentication involves the use of a person’s unique physiological or behavioral characteristics, such as fingerprint, face, voice, or iris, to verify their identity.

One of the most significant impacts of biometrics on the fintech industry is improving security. Traditional authentication methods such as passwords, PINs, and security questions are vulnerable to hacking, phishing, and other forms of fraud. Biometric authentication, on the other hand, provides a higher level of security as it is difficult to fake or replicate someone’s unique physical or behavioral characteristics.

The use of biometrics technology also improves the user experience and increases convenience. With biometric authentication, users can quickly and easily access their financial accounts without the need to remember complex passwords or carry physical tokens. This makes the user experience more seamless and frictionless, which is critical in the competitive fintech industry.

Another impact of biometrics on the fintech industry is the reduction in costs associated with fraud prevention. Financial institutions and fintech companies spend a significant amount of money on fraud prevention measures such as identity verification and fraud detection. Biometric authentication can help reduce these costs by providing a more secure and efficient way to authenticate users.

Biometrics is also driving innovation in the fintech industry. Companies are exploring new use cases for biometric authentication, such as voice recognition for customer service and behavioral biometrics for fraud detection. This innovation is driving competition and differentiation in the market, which ultimately benefits consumers.

In summary, biometrics has had a significant impact on the changing fintech industry. It has improved security, increased convenience, reduced costs, and driven innovation. As biometric technology continues to advance, it is likely to play an even more significant role in the future of fintech.

What are the identification modes of biometrics in the fintech industry

Biometric identification refers to the process of verifying an individual’s identity using their unique physiological or behavioral characteristics. In the fintech industry, biometric identification is used to provide a more secure and convenient way of authentication. The main identification modes of biometrics in the fintech industry are:

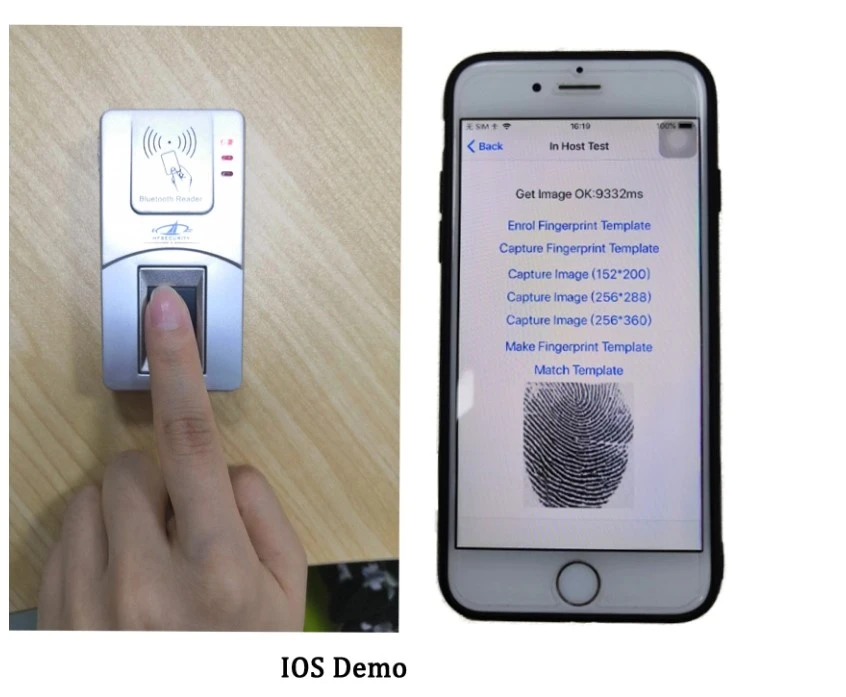

Fingerprint recognition

This is the most widely used mode of biometric identification in the fintech industry. It involves capturing the unique patterns on an individual’s fingertips and using them to verify their identity.

Facial recognition

This mode of biometric identification involves using a camera to capture an individual’s facial features, such as the distance between the eyes, the shape of the nose, and the contours of the face, and using them to verify their identity.

Iris recognition:

This mode of biometric identification involves capturing the unique patterns in an individual’s iris, which is the colored part of the eye, and using them to verify their identity.

Voice recognition:

This mode of biometric identification involves capturing an individual’s voice and using it to verify their identity.

Behavioral biometrics

This mode of biometric identification involves analyzing an individual’s behavior, such as their typing speed, mouse movements, and the way they hold their mobile device, to verify their identity.

These biometric identification modes are used in various fintech applications, such as mobile banking, online payments, and digital wallets, to provide a more secure and convenient way of authentication for users.

What are the advantages of biometrics in the financial industry

Biometrics refers to the use of unique biological characteristics, such as fingerprints, iris scans, and facial recognition, to identify individuals. The financial industry has increasingly adopted biometric technology in recent years, and here are some advantages of biometrics in the financial industry:

Enhanced security

Biometric authentication provides a high level of security compared to traditional authentication methods such as passwords or PINs, which can be easily compromised. Biometric features are unique to each individual, making it difficult for fraudsters to impersonate someone else.

Convenience

Biometric authentication is quick and easy, requiring no memorization or management of passwords, PINs or tokens, and can be done through mobile devices. This saves time and provides a better user experience for customers.

Cost-effective

Biometrics technology authentication eliminates the need for expensive security tokens or smart cards, reducing the cost of security measures for financial institutions.

Fraud prevention

Biometric authentication can help prevent fraud by detecting and preventing unauthorized access to sensitive data or transactions. This can be especially important in the case of financial transactions, where large sums of money are often involved.

Compliance with regulations

Biometric authentication can help financial institutions comply with regulations, such as KYC (Know Your Customer) requirements, as it can help verify the identity of customers and prevent money laundering.

Overall, biometric technology has numerous advantages for the financial industry, providing a secure, convenient, cost-effective, and compliant solution for identity verification and transaction authorization.

What are the disadvantages of biometrics in the financial industry?

While biometrics offer several advantages for the financial industry, there are also some potential disadvantages to consider:

Privacy concerns:

Biometric data is personal and sensitive information, and there may be concerns about how financial institutions handle and store this data. Customers may be hesitant to share their biometric data, particularly if they are unsure how it will be used and protected.

False positives and false negatives:Biometric technology is not infallible, and there is a risk of false positives (where an authorized person is denied access) or false negatives (where an unauthorized person is granted access). This can lead to frustration for customers and potential security risks for financial institutions.

Technical issues:

Biometrics technology requires specialized hardware and software, which can be costly to implement and maintain. Technical glitches can also occur, causing delays and inconvenience for customers.

Vulnerability to spoofing:

Biometrics systems may be vulnerable to spoofing or hacking, where fraudsters attempt to fake or manipulate biometric data to gain unauthorized access. This can be particularly concerning in the case of high-value financial transactions.

Integration challenges:

Integrating biometric technology with existing financial systems and processes can be complex and time-consuming, particularly for larger organizations with legacy IT infrastructure.

Overall, while biometric technology offers many benefits for the financial industry, financial institutions should carefully consider the potential drawbacks and work to mitigate these risks to ensure the security, privacy, and convenience of their customers.

Do financial companies have a choice of biometric methods?

Yes, financial companies have a choice of biometric methods to use for identity verification and authentication purposes. There are several types of biometric methods available, including:

Fingerprint recognition:

fingerprint scanner recognition is the most commonly used biometric method, which captures the unique patterns of ridges and valleys on an individual’s fingertip.

Face recognition:

This method uses facial features such as the eyes, nose, and mouth to identify an individual.

Iris recognition:

This method uses the unique patterns in the colored part of the eye to identify an individual.

Voice recognition:

This method uses the unique characteristics of an individual’s voice, such as tone and pitch, to identify them.

Behavioral biometrics:

This method uses an individual’s behavior, such as typing rhythm or mouse movement, to identify them.

Financial companies may choose to use one or more of these methods depending on their specific needs, the level of security required, and the preferences of their customers. The choice of biometric method may also depend on the type of transaction being carried out, with higher-value transactions requiring more secure authentication methods. Ultimately, financial companies must balance the benefits of biometric technology with the potential risks and challenges associated with its implementation.

How to choose the biometric methods that meet the financial industry

Choosing the right biometric method(s) for the financial industry requires careful consideration of several factors. Here are some steps to help guide the decision-making process:

Identify the use case:

The first step is to identify the specific use case for biometric technology. This may include customer authentication for online banking, identity verification for new account opening, or transaction authorization for high-value transactions.

Determine the level of security required:

The level of security required will depend on the specific use case. For example, high-value transactions may require more secure authentication methods than online banking access.

Consider the user experience:

The biometrics technology method chosen should be user-friendly and easy to use for customers. It should not cause frustration or delays, as this can negatively impact the customer experience.

Evaluate the accuracy and reliability of the method:

The biometric method chosen should be accurate and reliable, with a low rate of false positives and false negatives.

Assess the cost and feasibility of implementation:

The cost and feasibility of implementing the chosen biometric method(s) should be evaluated. This includes factors such as hardware and software requirements, integration with existing systems, and maintenance and support costs.

Consider compliance requirements:

The chosen biometric method(s) should meet compliance requirements, such as KYC (Know Your Customer) and GDPR (General Data Protection Regulation) regulations.

Test and evaluate:

Once a biometric method has been selected, it should be tested and evaluated thoroughly before deployment to ensure it meets the necessary security, accuracy, and usability requirements.

By following these steps, financial companies can choose the biometric method(s) that best meet their needs and help to improve security and convenience for their customers.

Summarize the impact of biometrics in the financial industry

biometrics technology have had a significant impact on the financial industry by providing a more secure and convenient way of identifying and authenticating customers. By using biometric data such as fingerprints, faces, and voices, financial institutions can reduce the risk of identity theft and fraud, streamline authentication processes, and improve the customer experience.

Biometrics technology also helps financial companies comply with regulations and improve operational efficiency. However, there are potential drawbacks to consider, such as privacy concerns, technical issues, and vulnerability to spoofing. Overall, the adoption of biometrics in the financial industry has had a positive impact on security, convenience, and efficiency.